Germany promises more renewables but big utilities take back control, writes Arne Jungjohann

For many years, the policy instrument of choice was a feed-in tariff (FIT). It guaranteed a fixed payment for (in most cases) 20 years and priority grid access for renewables. The policy provided high investment certainty and triggered tremendous growth in renewable power generation capacity.

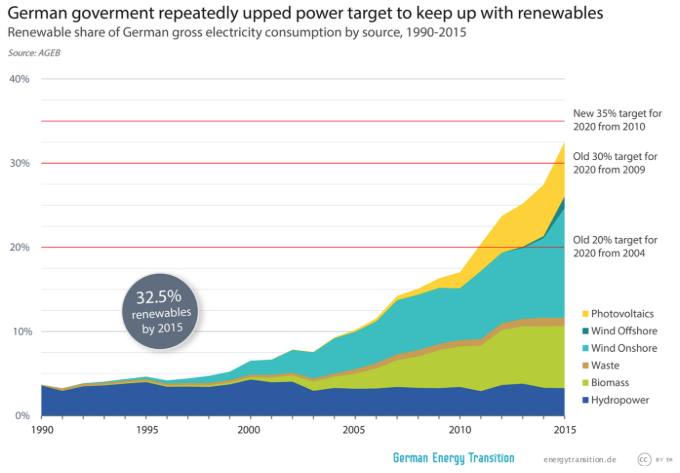

When the initial law was introduced in 1990, the role of renewables in Germany’s power mix was negligible. By 2015, renewable electricity made up 32% of consumption and had grown at speed exceeding all expectations. The government repeatedly had to upgrade its targets to keep up with renewables growth.

But a couple of weeks ago, the German government put forward plans to overhaul the Energiewende’s flagship policy. The planned reform of the Renewable Energy Sources Act includes a switch from feed-in tariffs to auctions.

Sigmar Gabriel,

Energy Minister and party leader of the Social Democrats, hails the

reform as a paradigm shift in the way renewables are funded: “More

competition, continuous growth with effective steering, restrictions on

costs, stakeholder diversity and dovetailing with grid expansion - these

are the coordinates for the next phase of the energy transition.”

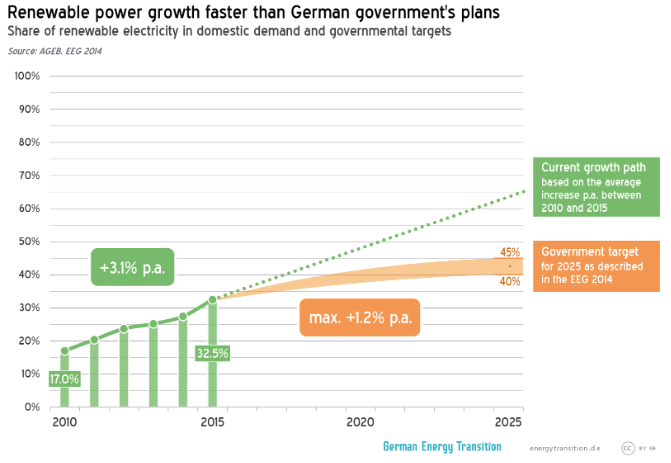

With the reform, the government reiterates previously set

goals to increase the share of renewable electricity to 40-45% in 2025,

to 55-60% in 2035 and to at least 80% by 2050.

But to keep a steady hand on the rise in renewable power, a “deployment corridor” will set limits on how much renewables capacity may be added per year. These limits are set per technology: For onshore wind, a gross amount of 2,800 megawatts is to be auctioned each year over the next three years (2017, 2018 and 2019), increasing thereafter.

But to keep a steady hand on the rise in renewable power, a “deployment corridor” will set limits on how much renewables capacity may be added per year. These limits are set per technology: For onshore wind, a gross amount of 2,800 megawatts is to be auctioned each year over the next three years (2017, 2018 and 2019), increasing thereafter.

For solar, 600 megawatts will be auctioned each year, and

the overall corridor of 2,500 megawatts per year will remain (the

remainder being built under FITs). For offshore wind, the overall target

is 15,000 megawatts by 2030.

For biomass, 150 megawatts are annually up for auction in

2017, 2018 and 2019. Small renewables installations like rooftop solar

will continue

to receive feed-in tariffs (with small changes). The government

believes this will ensure that citizen cooperatives and project

developers remain active in operating small renewables plants.

These limits have been attacked for protecting old coal power plants at the expense of renewables. But the government argues it is making renewables deployment more predictable, thereby facilitating grid expansion and improving planning security for Germany’s neighbours and for the energy industry. After all, Chancellor Merkel promised the Energiewende must not destroy German utilities.

Critics argue that the government is putting the brakes on the Energiewende. Green campaigners see the limits for onshore wind power, the most cost-competitive renewable technology, as a sign that the government is trying to slow the rapid growth of renewables.

In light of past growth rates, the concern seems justified. Since 2010, Germany has increased the share of renewables in electricity demand by annually 3.1% on average. If this growth path continued, the country would reach more than 60% renewables by 2025. With the new proposal, however, the government wants to ensure that renewables growth does not exceed its 2025 target of 40% to 45%.

These limits have been attacked for protecting old coal power plants at the expense of renewables. But the government argues it is making renewables deployment more predictable, thereby facilitating grid expansion and improving planning security for Germany’s neighbours and for the energy industry. After all, Chancellor Merkel promised the Energiewende must not destroy German utilities.

Critics argue that the government is putting the brakes on the Energiewende. Green campaigners see the limits for onshore wind power, the most cost-competitive renewable technology, as a sign that the government is trying to slow the rapid growth of renewables.

In light of past growth rates, the concern seems justified. Since 2010, Germany has increased the share of renewables in electricity demand by annually 3.1% on average. If this growth path continued, the country would reach more than 60% renewables by 2025. With the new proposal, however, the government wants to ensure that renewables growth does not exceed its 2025 target of 40% to 45%.

Anna Leidtreiter of the World Future Council expects these changes will fundamentally threaten Germany`s leadership position within energy and climate politics, but also lead to significant job losses and reduce business opportunities for entrepreneurs.

The switch from feed-in tariffs to auctions would weaken

investment opportunities for small investors, energy cooperatives,

farmers and enterprises, she says. “Citizens are essentially the

backbone of the energy transition in Germany. Energy cooperatives alone

have invested about 1.3 billion euros (9.5 billion yuan) in RE projects,

thus generating revenues for communities, regions and

citizens," Leidtreiter argues.

Indeed, the Energiewende has democratised Germany’s power sector in the last few decades. Due to its inclusive design, the policy has enabled new stakeholders to enter the market. They have leveraged significant private investment over the past decade.

Indeed, the Energiewende has democratised Germany’s power sector in the last few decades. Due to its inclusive design, the policy has enabled new stakeholders to enter the market. They have leveraged significant private investment over the past decade.

More than 800 energy cooperatives as well as private

investors, farmers, banks and enterprises owned almost 90% of total

installed renewables capacity at the end of 2012. In contrast,

traditional utilities and energy suppliers invested very little and thus

lost market shares.

Up to now, the Renewable Energy Act has been a tremendous success story. As the International Renewable Energy Association (IRENA) says, Germany has shown the world that such a high level of renewables can be integrated without systemic problems, thanks to strong grid infrastructure and cross-border exchange links.

But the Energiewende as we know it is at a crossroads. So far citizens, communities and new investors have been the biggest drivers for the energy transition. If the caps and the switch from feed-in tariffs to auctions are implemented, large corporations will dominate the market.

The reform would exclude many potential investors,

including citizens, whose billions of euros would be welcomed to finance

the transformation to a low-carbon economy. A recent analysis by the

Climate Policy Initiative (CPI) concludes

that more than 30 billion euros a year could be available for

investment in the expansion of renewable energy capacity in Germany as

long as the country shifts policy effectively to deal with the next

phase of the energy transition and keeps investment open.

These concerns are being discussed in Berlin. For

international observers, it is important that broad sections of the

country know that ownership matters in the energy sector.

The law is expected to be passed before the summer recess by the Bundestag (lower house) and the Bundesrat (upper house). It will be the government’s final major piece of energy legislation before the federal elections in 2017. The Energiewende will move forward.

The law is expected to be passed before the summer recess by the Bundestag (lower house) and the Bundesrat (upper house). It will be the government’s final major piece of energy legislation before the federal elections in 2017. The Energiewende will move forward.

Whether or not the reform puts Germany on track to

cut greenhouse gas emissions by 40% by 2020 in comparison to 1990

remains to be seen. Either way, slowing down renewables growth to

protect old coal plants is not what the world expects from a global

climate leader. Germany’s next government will have to address the

challenge of a coal phase-out and how to expand the Energiewende to the

heat and transport sector.

courtesy:chinadialogue

Comments